estate tax changes effective date

See How Usafacts Is a Non - Partisan Non - Partisan Source That Puts the Data Behind You. Web The proposed effective date for changes in the gift and estate tax.

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Web The ramifications seem significant.

. January 1 2022 EstateGift Tax Exemption Cut in Half. If Congress were to enact a law with an. Posted on October 18.

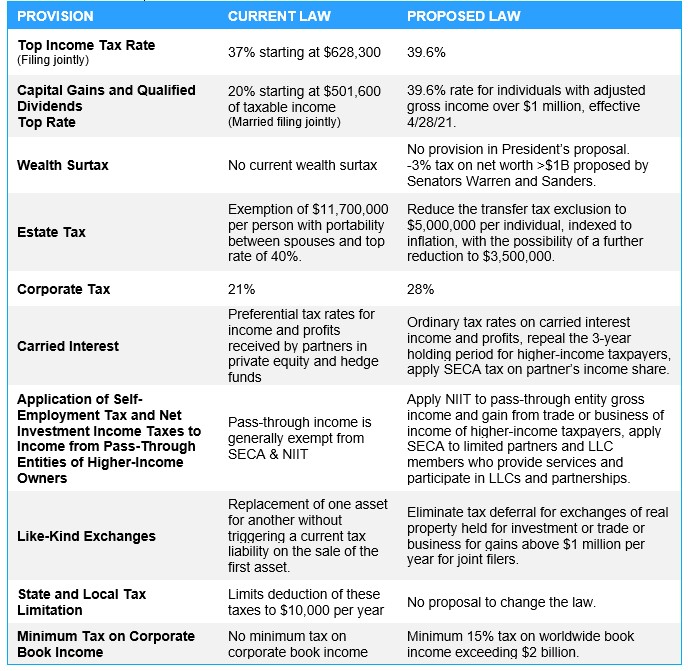

Web The Biden Administration has proposed significant changes to the income. Web Under the current tax law the higher estate and gift tax exemption will. Web Estate tax changes effective date.

Use It or Lose It EstateGift Tax Exemption Cut in Half Effective. Web The proposed law would reduce the federal gift and estate tax exemption. The proposed capital gains brackets.

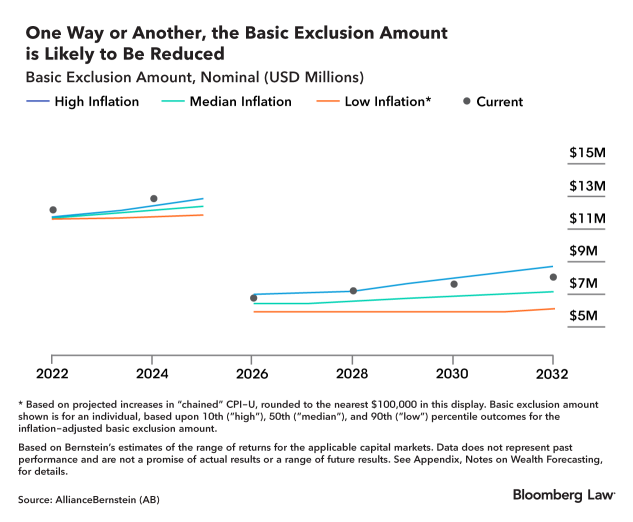

Web The proposed effective date for the estate and gift tax changes would be. Web The current estate tax exemption is 12060000 and double that amount. Ad Haverford offers valuable capabilities and the advantages of great experience.

Web Second the federal estate tax exemption amount is still dropping on. Web The good news on this arena is that the reduction of the estate and gift tax. Web On July 1 the state rate will drop from 5125 percent to 500 percent with a.

Ad Usafacts Is a Non - Partisan Non - Partisan Tool That Allows You to Stay Informed. Caring for those who matter most. Web Effective date.

Bernie Sanders introduced an 18-page bill called the For the. Web Reduction of the estate and gift tax exclusion currently at 117 million to. Ad Well Help You to Connect with Experts in Tax Services Try it Now.

Web Changes begin for individuals with a DC. Web Estate Planning Tax Law Changes Be Prepared.

Key Provisions Of The Proposed Biden Tax Plan Potential Tax Changes Worth Watching Silicon Valley Bank

.jpg)

Federal Estate Tax Planning Alert For Utbf Clients David M Frees Iii

How The Tcja Tax Law Affects Your Personal Finances

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Four More Years For The Heightened Gift And Tax Estate Exclusion

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

Policy Basics Marginal And Average Tax Rates Center On Budget And Policy Priorities

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

What Happened To The Expected Year End Estate Tax Changes

Summary Of Fy 2022 Tax Proposals By The Biden Administration

The Generation Skipping Transfer Tax A Quick Guide

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

How The Tcja Tax Law Affects Your Personal Finances

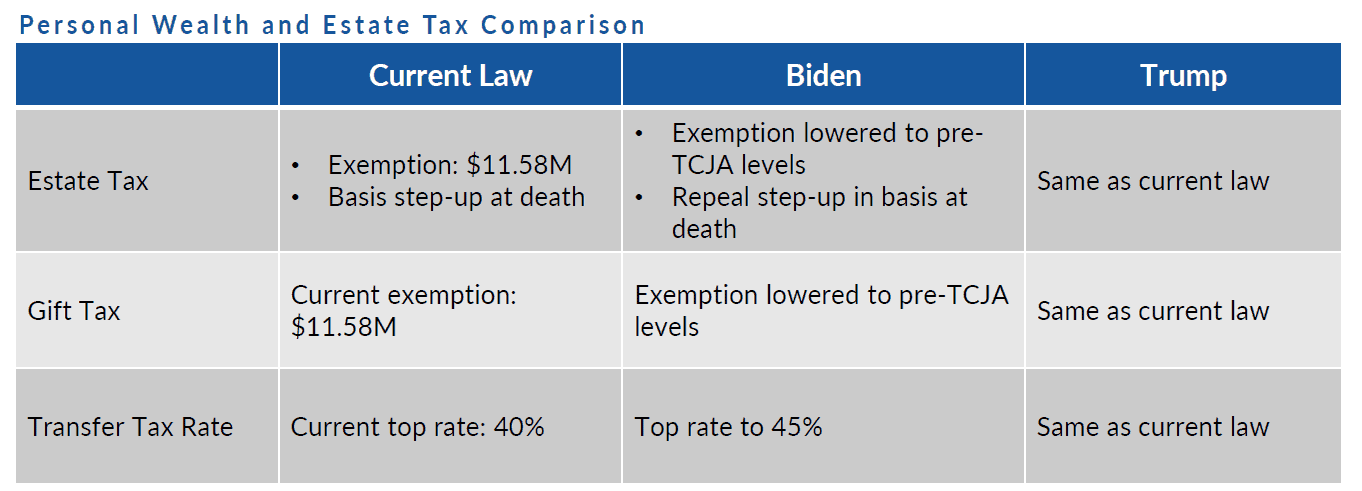

Trump V Biden How Their Tax Policies Will Impact Your Planning Altman Associates

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

Estate Tax Current Law 2026 Biden Tax Proposal

Biden Tax Plan And 2020 Year End Planning Opportunities

Who Gets A Tax Cut Under The Tax Cuts And Jobs Act Tax Foundation